The Castle Property

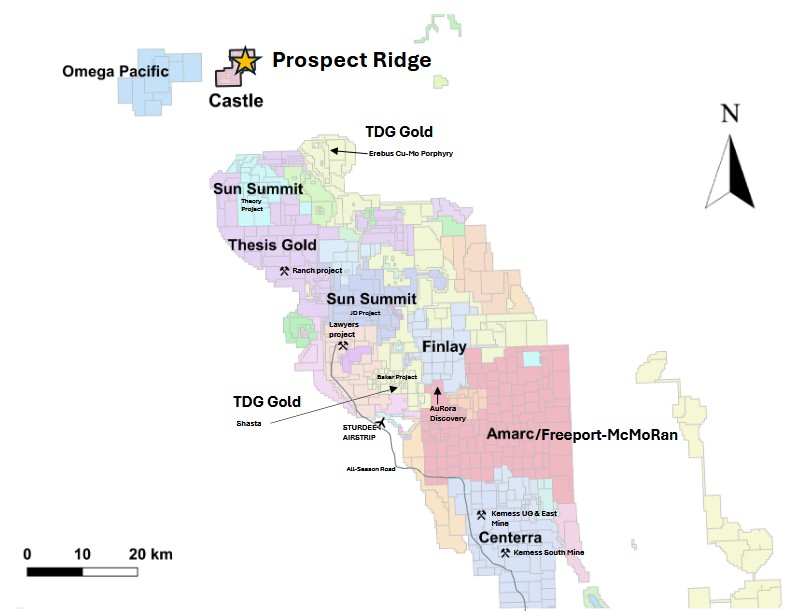

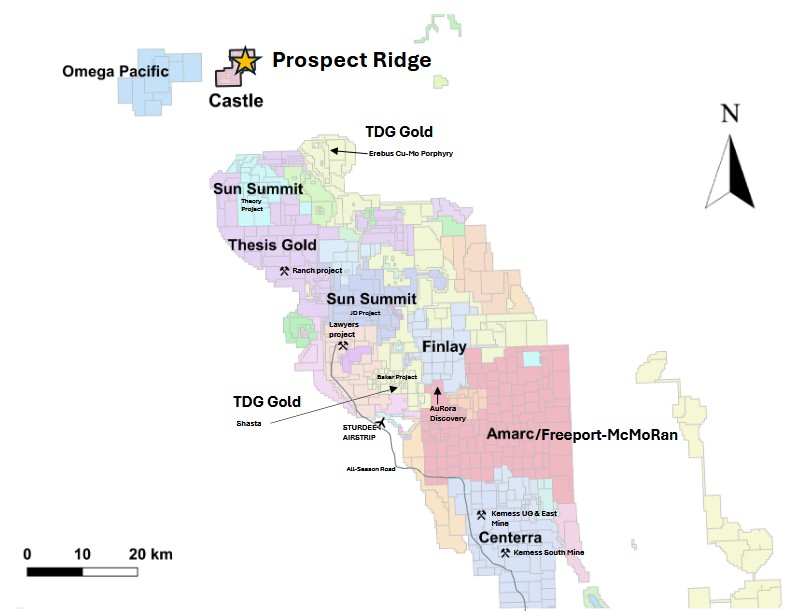

Figure 1 – Castle property location in relation to Thesis Gold’s Ranch and Lawyers projects and Amarc’s AuRora discovery, Kemess South historic mine and Kemess UG & East mines

The Castle property consists of 14 contiguous mineral claims covering 29.14 km2 in the prolific Toodogone gold-copper mineral district in north-central B.C. Castle is located approximately 100 km north-west of the Kemess mine complex and 66 km south-east of the advanced stage Kutcho Copper VMS deposit and is accessible by helicopter from the Sturdee airstrip.

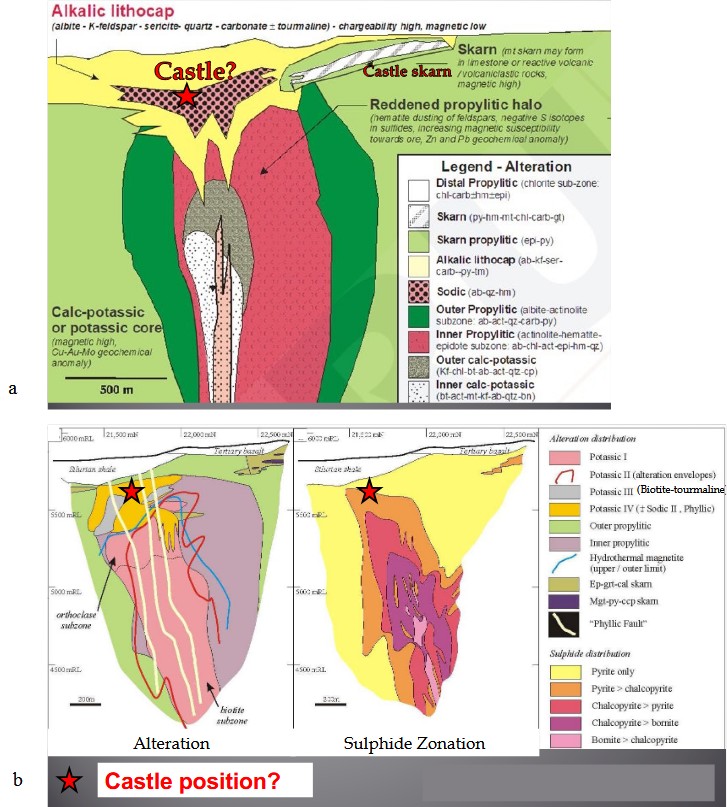

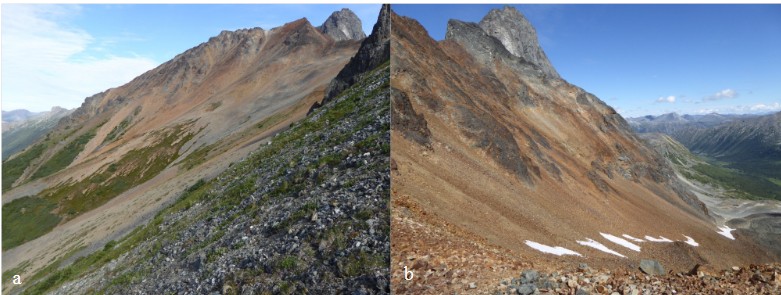

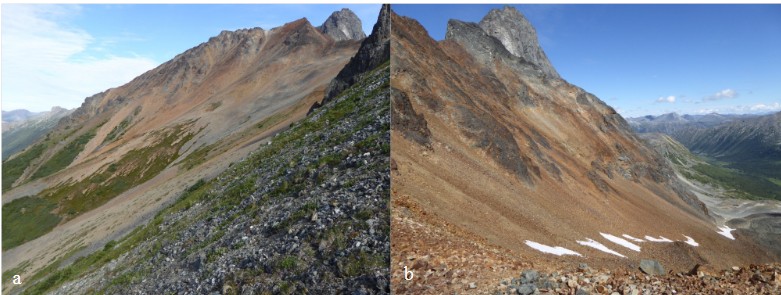

The main target at Castle is an alkalic Cu-Au porphyry deposit at depth. Markers of this potential deposit include (i) a kilometre-scale Au-Cu-Pb soil (talus fines) surface anomaly, (ii) the striking Castle and Abbey Gossans (Figure 3) and (iii) proximity to a prominent clay-K-feldspar-pyrite altered feldspar porphyry. Other attributes include:

Geology:

- 1,200 x 1,500 m feldspar porphyry stock or dyke swarm dated at approximately 210 Ma

- Pervasive K-feldspar-clay-pyrite alteration of feldspar porphyry throughout stock/dyke swarm

- Pervasive alteration cut by sheeted leached and oxidized mm scale albite-pyrrhotite (+Au+base metal sulphides?) veinlets

Age date by U-Pb dating:

- Confidential age-dating data suggests similar age as nearby Red Chris (204 Ma) and Kemess (201 Ma) Au-Cu porphyry deposits

Strong Au-Cu-Mo-Pb-As-Bi soil geochemistry:

- Coincident with the altered feldspar porphyry stock or dyke swarm

- Maximum soil values: 8 g/t Au, 1070 ppm Cu, 23 ppm Mo, 188 ppm Pb, 104 ppm As, 97 ppm Bi*

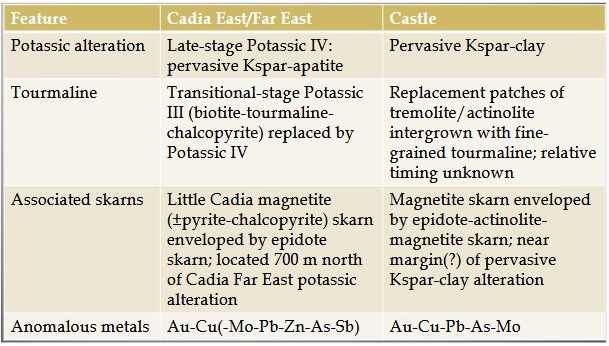

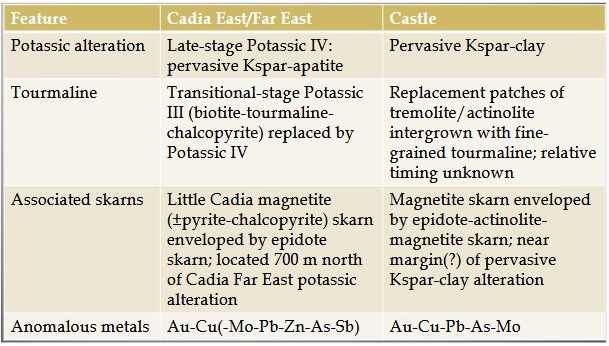

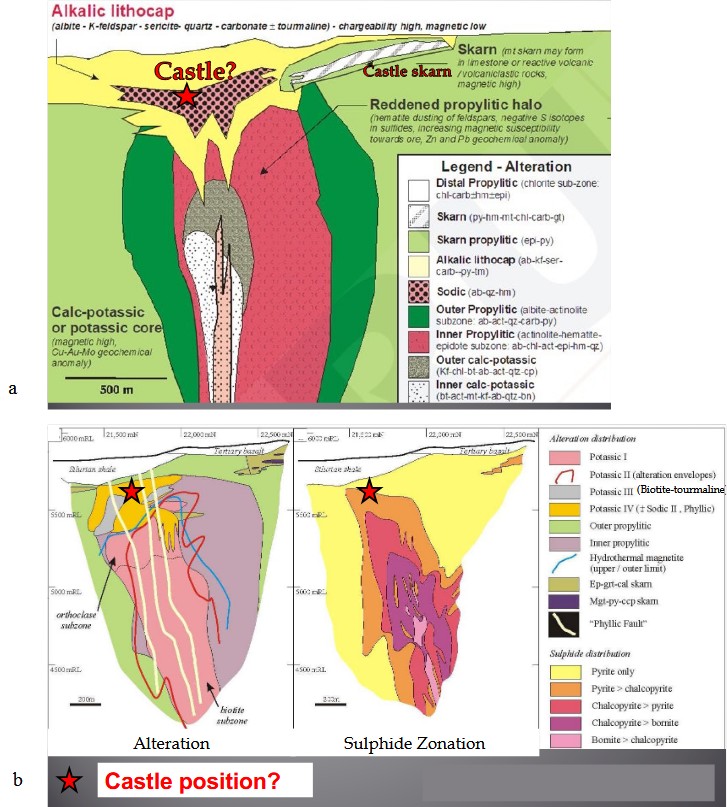

Strong comparison with upper levels of Cadia alkalic Au-Cu porphyries (Figure 2):

Figure 2: (a) Showing conceptual cross -section of an intact alkalic Cu-Au porphyry deposit at depth with the hypothesized location of the top of the Castle gossan; (b) interpreted cross-section of the Cadia Far Fast deposit with hypothesized top of Castle gossan shown with a red star.(*Source: Wilson 2003)

Phase 1 Exploration Plans

A Phase 1 Field Program is currently being conducted by Prospect Ridge and Equity Exploration Consultants Inc. with a budget of $390,000 and is designed to provide the information required to establish drill targets.

At Castle and Abbey, a 500 line-km airborne magnetic survey is to be completed over the entire property. The magnetic survey will follow an ~7 line -km 3D IP survey covering the north and west Castle gossan slopes. Concurrently, a program of prospecting and mapping is being conducted over both the Castle and Abbey gossans.

The object of the Phase 1 program is to provide multiple drill targets for a minimum 2,500 metre diamond drill program contemplated for as early as the summer of 2026, pending receipt of drill permits.

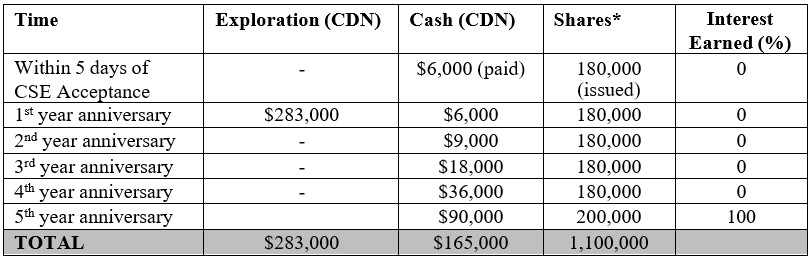

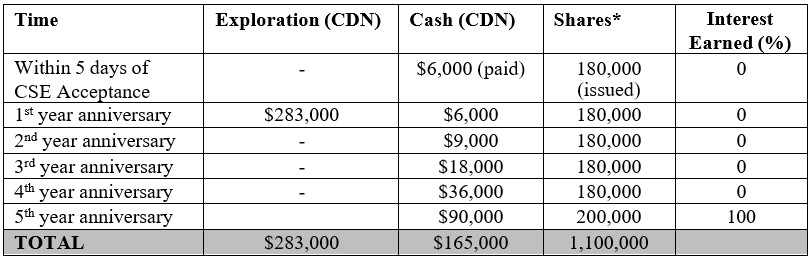

Acquisition Terms

Under the terms of the Agreement, which has received Canadian Securities Exchange (“CNX”) approval, Prospect Ridge can earn a 100% interest in the project by completing the following:

* Shares valued at the greater of the 10 day volume weighted average price or discounted market value prior to each anniversary date.

Once Prospect Ridge has completed the Phase 1 work program and paid the initial share and cash compensation it may elect to return all or part of the project to the Vendors with two years good standing with an additional three years of assessment applied on those claims that have passed their ten year anniversary date since staking. Providing that Prospect Ridge continues to make cash and share payments on the anniversary dates it will earn a 100% interest in the project, subject to a 1.5% NSR royalty in favour of the Vendors of which 0.9% can be bought for $400,000 on or before the first NI-43-101 indicated mineral resource, $800,000 on or before the publication of a scoping study (PEA), and at anytime thereafter for $1,600,000.

The Vendors will also be entitled to annual Advance Royalty Payments (“ARP”) payments of $6,000 per year commencing on the sixth anniversary of the Acceptance Date and increasing to $12,000 per year commencing on the eleventh anniversary of the Acceptance Date and then increasing to $18,000 per year commencing on the fifteenth anniversary of the Acceptance Date and continuing for as long as Prospect Ridge or successor owns the permits. All amounts provided as advance royalty payments can be paid in shares, at Prospect Ridge’s option and will be deductible from future NSR royalty payments.

First Nations Land Acknowledgement

Prospect Ridge acknowledges that Castle is situated within the traditional territory of the Tahltan and Kaska Dena First Nations and access may involve crossing territories claimed by the Takla, Tsay Key Dene and Kwadacha First Nations. Prospect Ridge is committed to developing positive and mutually beneficial relationships with First Nations based on trust and respect and a foundation of open and honest communications.

Sources of Technical Information

- Awmack, J. 2015. Geological and Geochemical Report on the Castle Project. B.C. Mines Branch Assessment Report 35663, page 12.

- Poloni, R., 1998, Assessment Report on the Mountain Claim: British Columbia Ministry of Energy and Mines Assessment Report 25535, page 40.

- Vulimiri, M. R., and Crawford, S. A., 1980, Geochemical and Prospecting Report on the Magic Mountain Group: British Columbia Ministry of Energy and Mines Assessment Report 9335, page 19.

Qualified Person Statement

All technical data, as disclosed on this website, has been verified by Ron Voordouw, Ph.D, P.Geo. Director of Geoscience for Equity Exploration Consultants Ltd., a consultant to the Company and a qualified person as defined under the terms of National Instrument 43-101.