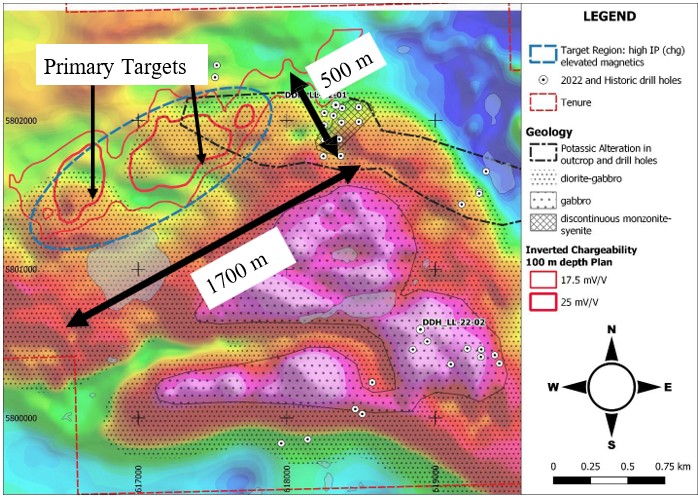

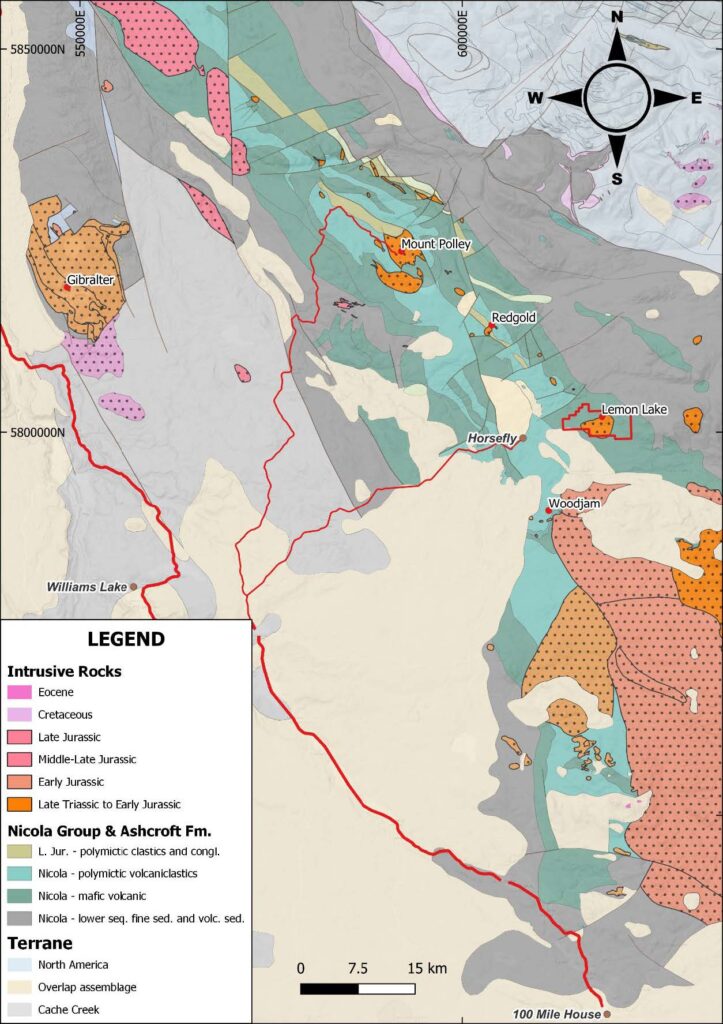

Figure 1 – Camelot location map*

Figure 1 – Camelot location map*

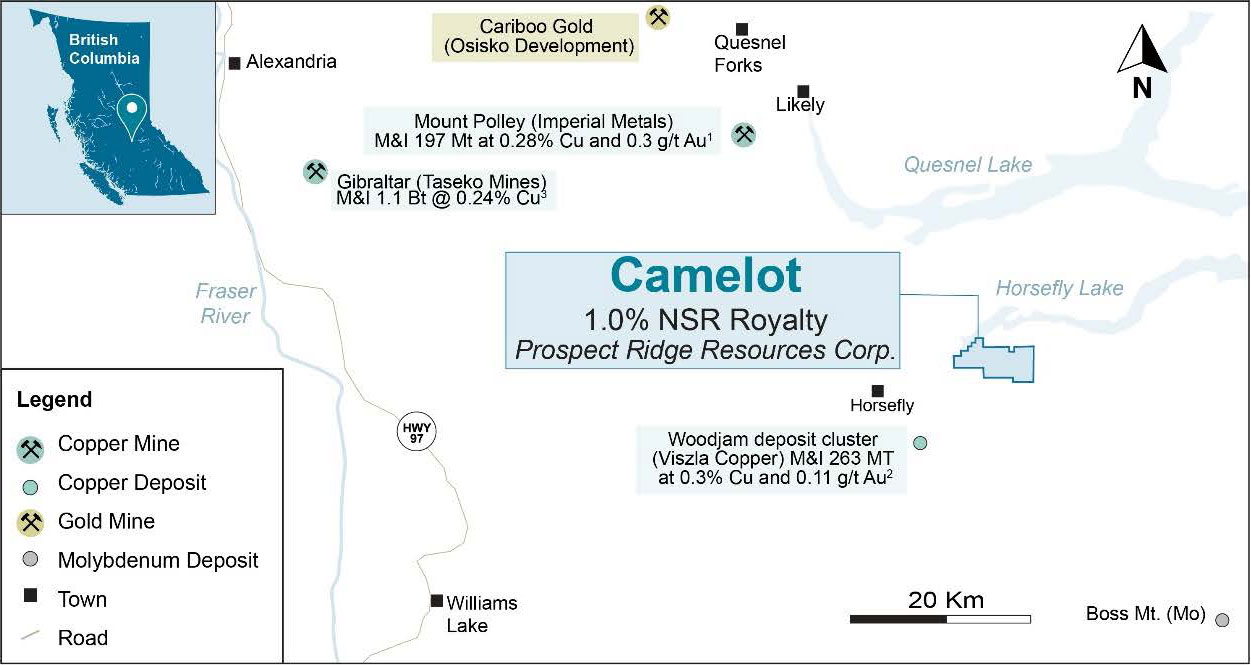

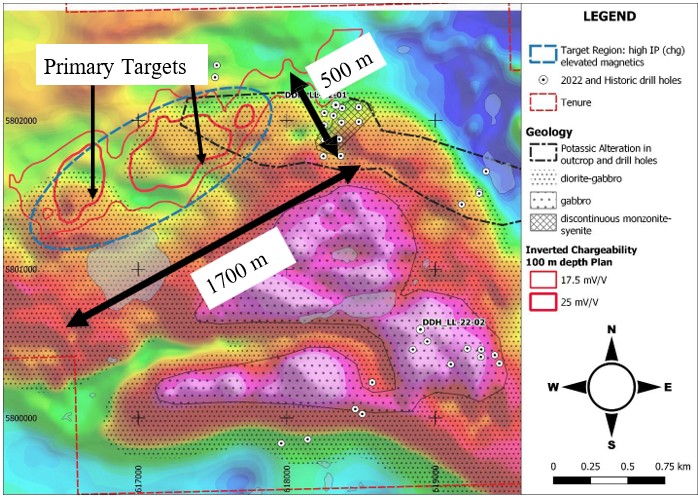

In 2011, a 3D Induced Polarization (IP) survey was completed over the soil anomaly and northern limit of the stock. The surveys outlined a 2,800 by 600 metre zone of chargeability centered on the altered monzonite phase of the intrusion. The copper intercept in the historic drilling is located on the northeastern margin of the IP anomaly, and no historic drilling has tested the core of the chargeability anomaly.

In 2022 a previous operator completed a two hole, steeply dipping, 501 m drill program targeting mineralization identified by historic percussion and RC drill holes. Both holes were drilled away from the north-eastern edge of the IP anomaly near the northern and southern margins of the property. The northerly hole confirmed the presence of moderate intensity potassic alteration and copper mineralization, whereas the southern hole intersected late post-porphyry fault related mineralization.

The limited 2022 drilling program did not test the most compelling target on the property. Recent airborne magnetics from 2021 combined with the 2011 IP survey and geological mapping indicate a 1.7 kilometre long trend of coincident chargeability and moderate magnetic highs in an overburden covered area never tested by drilling. The target model is focused on an alkalic porphyry system lacking significant quartz-sericite-pyrite alteration (phyllic-style) where high chargeability and coincident magnetics may indicate pyrite-chalcopyrite mineralization in association with potassic (magnetite) alteration. Exploration on the Camelot Property has so far been focused in areas of outcrop exposure, however, considering the encouraging geophysical anomalies future exploration should focus on till covered areas over large scale geophysical targets.

Figure 2: Property geology, soil geochemistry and IP data compilation over Airborne TMI (total magnetic intensity) map (after Baknes, 2023 “2022 Drilling report on the Camelot Property: Assessment Report B.C. Ministry of Energy and Mines)

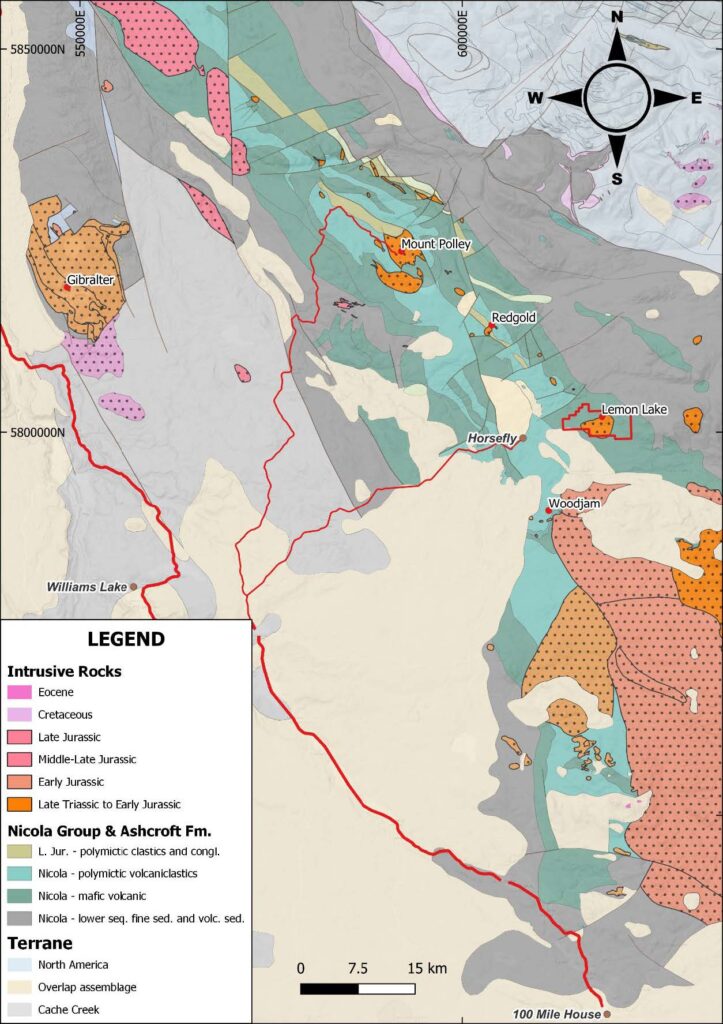

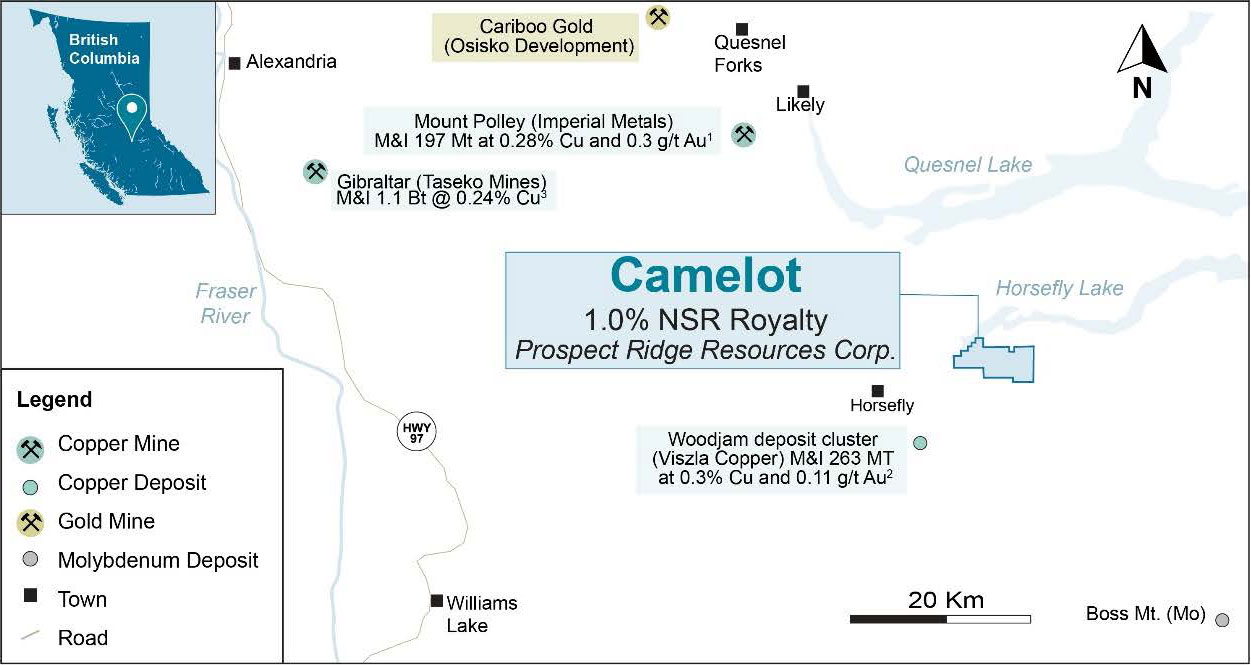

Figure 3: Regional Geological Setting of the Camelot Property (Logan et. al., 2010 Bedrock Geology of the QUEST map area, central British Columbia; British Columbia Geological Survey, Geoscience Map 2010-1, Geoscience BC Report 2010-5 and Geological Survey of Canada, Open File 6476)

Acquisition Terms

Prospect Ridge can acquire a 100% interest in the Camelot property, subject to an aggregate 1% NSR royalty held by an underlying royalty holder and the granting of a 1% NSR royalty to Orogen, for a total consideration of $200,000 with $25,000 in common shares of Prospect Ridge based on a 10-day volume weighted average price ( “VWAP”) to be paid within five days of regulatory approval (the “Approval Date”), and $175,000 to be paid in cash or common shares of Prospect Ridge (subject to a 10-day VWAP) at the sole discretion of Prospect Ridge within six months and two days of the Approval Date. All Shares issued by Prospect Ridge will be subject to a restricted resale period of four (4) months plus one (1) day in accordance with applicable securities laws. Prospect Ridge will be able to buydown 0.5% of the underlying 1% NSR royalty for a one time payment of $1,000,000. Prospect Ridge will also be responsible for an annual Advance Royalty payment of $10,000 and a onetime payment of $30,000 upon completion of a NI-43-101 mineral resource that will be due to the underlying royalty holder.

Land Acknowledgement

Orogen and Prospect Ridge acknowledge that Camelot is situated within the traditional territory of the Williams Lake Indian Band, Xatsull First Nation and the Neskonlith Indian Band. Both companies are committed to developing positive and mutually beneficial relationships with First Nations based on trust and respect and a foundation of open and honest communications.

Qualified Person Statement

All technical data regarding Camelot, has been verified by Laurence Pryer, Ph.D., P.Geo. Vice-President Exploration for Orogen Royalties Inc. Dr. Pryer is a qualified person as defined under the terms of National Instrument 43-101.

*Sources for Figure 1 resources:

Mt. Polley: www.imperialmetals.com/assets/docs/mp-technical-report-may-20-2016.pdf

QR: https://osiskogr.com/en/osisko-gold-royalties-announces-spin-out-of-mining-assets-and-creation-of-a-premier-north-american-gold-development-company/

Woodjam: www.vizslacopper.com/projects/woodjam-project/overview/

Sources of Technical Information

- Baknes, . J. 2023. Drilling Report on the Lemon Lake Project. B.C. Mines Branch Assessment Report Event No.5993800

- Britton, R., 2021 2021 Geological – hand trenching, airborne Magnetic – VLF survey and petrological reports on the Lemon Lake property C. Mines Branch Assessment Report 39604

- Bailey, 2012 Lemon Lake property Horsefly Induced Polarization and Magnetometer Survey

B.C. Mines Branch Assessment Report 33088.

Qualified Person Statement

All technical data, as disclosed on this website, has been verified by Ron Voordouw, Ph.D, P.Geo. Director of Geoscience for Equity Exploration Consultants Ltd., a consultant to the Company and a qualified person as defined under the terms of National Instrument 43-101.

Figure 1 – Camelot location map*

Figure 1 – Camelot location map*