With the publication of quarterly results last week and the achievement of full-year targets, the share of the second-largest gold producer Barrick Gold was able to gain. As a result, this also boosted the entire sector. In addition, the price of gold, which has maintained the USD 1,800 mark at a level of USD 1,830, provides support. The prospects for investments in gold shares remain good.

BARRICK GOLD – TARGETS ACHIEVED

While interest rate hikes are expected this year, high valuations in equity markets, particularly in the technology sector, and the correction and high volatility of cryptocurrencies, as well as the inflationary environment, all speak in favor of the precious metal. There is an increasing likelihood that gold – and, by extension, gold-stock shareholders – are in for a good year as part of a sector/asset rotation.

According to preliminary data, the Canadians produced 1.2 million ounces of gold in the fourth quarter, narrowly beating the lower end of the outlook range (4.4 to 4.7 million ounces) for the past fiscal year with 4.44 million ounces. On the cost side, there was a positive surprise. All-in sustaining costs (AISC), i.e. production costs per ounce, decreased by a mid-single-digit percentage compared to the third quarter. In copper production, which amounted to 126 million pounds in the final quarter, the Group benefited from significantly higher prices.

The share continues to be moderately valued. On average, analysts believe the shares have a price potential of 40%. On February 16, the Canadians will publish their final figures for 2021, and we eagerly await a more concrete outlook for the current fiscal year.

PROSPECT RIDGE RESOURCES – WILL THE “GOLDEN TRIANGLE” GET BIGGER IN 2022?

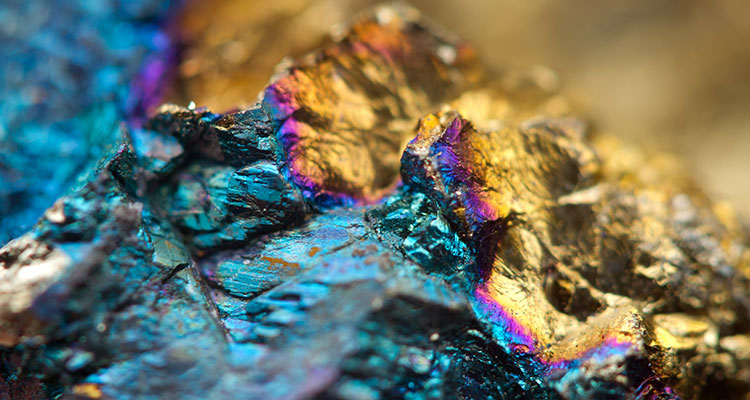

After setting a decisive course last year, the gold explorer should succeed in making its shareholders happy in 2022 through project progress. The Company completed two significant acquisitions with the Holy Grail and Knauss Creek properties. The properties, covering over 80,000 hectares, are located in northern British Columbia and are adjacent to the so-called “Golden Triangle”, home to numerous mines. With the new additions, the Canadians see the potential to extend the boundaries of the Golden Triangle to this large, unexplored region.

A total of six zones of visible gold have been identified on the two properties. New preliminary results show grades of up to 117 g/t gold and 4740 g/t silver. According to the Company, prospecting is expected to continue during the cold months. The new drilling program will start in spring, for which the Company has already defined four targets.

Exciting newsflow can be expected from this. In addition, half of the assay results from last year are still outstanding. A significant advantage of the project is the good infrastructural connection with highways, railroad lines, power lines and forest roads. Prospect Ridge Resources has also been active in the province of Québec for some time. The Galinee project consists of 15 contiguous mineral claims covering approximately 839 hectares.

To continue its expansion mode, the Company secured gross proceeds of nearly CAD 1.3 million at a share price of CAD 1 in a capital increase last December. As a result, the Canadians currently have CAD 5.2 million in their bank account. The timing factor also makes the stock attractive. The shares have lost half of their value in the last few weeks without understandable reasons. The stock market value is currently just under CAD 30 million.

GLENCORE – SUCCESS ACROSS THE BOARD

While many companies are saying goodbye to their “dirty” energy sources such as oil, gas or coal, Glencore remains true to its strategy of a broadly diversified commodity portfolio and gratefully holds out its hand on the buying side. The Swiss recently acquired the remaining shares in the Colombian coal mine Cerrejon from BHP and Anglo American and got in significantly cheaper than expected.

With great excitement, eyes turn to the next results announcements. On February 2, Glencore will announce key data for the final quarter, and then on February 15, it will present its results for the past fiscal year. Expectations in the market are very high; stock market players want to see nothing less than record results. And this optimism is also reflected in the share price. The share price is at a 10-year high, which means that the Company currently has a market capitalization of USD 73 billion.

Glencore specializes in the production and distribution of metals, minerals and petroleum products, primarily for the automotive, steel and food industries. With 2/3 of net sales, petroleum products, coke and coal play the decisive role. Here, the Swiss benefited from sharply rising prices in recent quarters. The rising prices of metals and minerals such as aluminum, zinc, copper, nickel and cobalt, which account for around a quarter of net sales, also played into the Group’s favor.

Are we already in a new commodity super-cycle, or are there only selective opportunities at the moment? Regardless of which opinion you hold, investors should be on the buy-side of commodities in the short and medium term. For those who want to cover a broad spectrum with one stock, Glencore is the right choice. For focused gold investments, heavyweight Barrick is a good choice. For those who are willing to take a higher risk with an explorer, which on the other hand, is associated with great opportunities, Prospect Ridge is worth considering.